Retail finance products such as BNPL and digital credit are in high demand – but what options are best suited to your business? The sustained rise of flexible payment types, which continue to erode the market dominance of traditional options like debit and credit cards, is mirroring the changing demands of consumers, helping them to buy what they want, when they want and how they want, according to Melanie Vala, CCO at multi-lender Buy Now Pay Later (BNPL) platform Deko …

Retail finance is essential for successful ecommerce operations, and furniture merchants need to consider their customers’ needs when deciding on the best payment products. It’s clear that shoppers want choice and are shying away from the more traditional lines of credit, which is why businesses must explore the full range of retail finance options available.

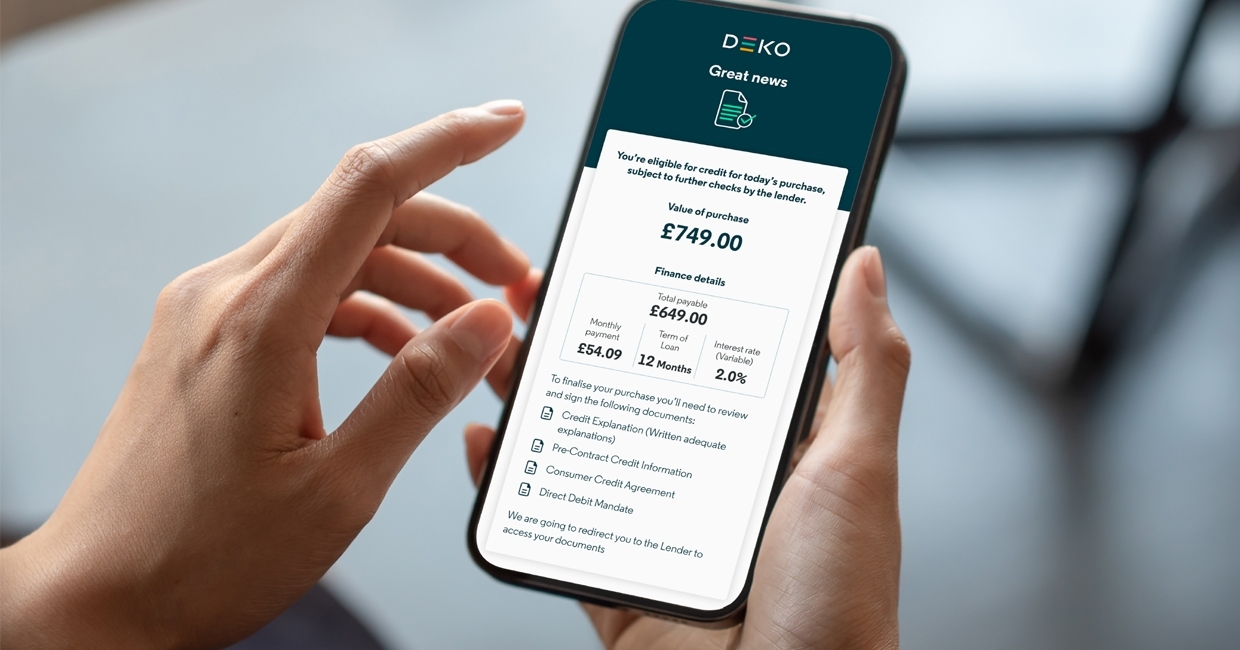

One important factor furniture merchants need to consider when choosing a product is the typical interest charged to repayments. Interest-free options allow customers to spread the cost of their purchase without incurring any additional interest on payments. In contrast, interest-bearing options see shoppers paying the interest on top of the repayment amount.

For furniture merchants, it’s not necessarily a question of one versus the other, as often a combination approach is optimal. For example, many merchants would benefit from offering interest-free finance on furniture products with lower price points, whilst also offering interest-bearing options for higher priced products that require a longer repayment period.

BNPL is one of the most popular payment methods among shoppers, providing an alternative option to traditional credit and allowing customers to spread the cost of a purchase over long-term instalments. Many BNPL products are interest-free, which is extremely appealing to shoppers at the moment.

Credit limits on typical BNPL solutions are often lower than finance instalment products, making it a more suitable option for furniture businesses with low-mid-range AOVs. However, furniture retailers are increasingly turning to digital credit products, which give customers more flexibility and improve repeat purchase rates and loyalty levels.

Digital credit offers the simplicity of BNPL and the functionality of a credit card account. It differs from traditional forms of credit, by using smartphone technology or web platforms to register, score, approve, and distribute. Credit amounts are higher, with customers often able to borrow up to a total of £5000 across purchases, spreading the cost over set repayment dates. Once consumers are approved for this credit product, they can seamlessly make regular purchases on your website, and won’t have to reapply. So, it’s the perfect option for those furniture merchants who are looking to turn customers into repeat buyers.

Businesses are unique, and what works for some furniture stores might not be the best fit for a company selling a different product range, or who is targeting a different target market. Therefore, understanding the customer's wants and needs will help businesses decide on the best retail finance option – one that is tailored to meet the needs of their individual shoppers.

According to a survey from PYMNTS, 60% of consumers prefer retail finance solutions such as BNPL to credit cards due to simple set payments, a smooth approval process and a lack of interest charges. Retail finance solutions offer a lower-impact spending tool, which has in particular, turned the heads of young consumers that are facing ever-increasing credit card interest rates. It is vital that retailers not only offer finance at checkout, but provide an option that is tailored to their customers’ needs.

Today's customers are savvier and expect different payment options from online stores as well as brick-and-mortar outlets. Retail finance helps furniture businesses sell more, boost revenue, build customer loyalty, and improve the chance of generating repeat business.